Tips to Build a ‘Financial Home’ for Your Future

“The wise man built his house upon the rock

The wise man built his house upon the rock

The wise man built his house upon the rock

And the rains came tumbling down

The rains came down and the floods came up

The rains came down and the floods came up

The rains came down and the floods came up

And the house on the rock stood firm”

Are you familiar with this song? This nursery rhyme was taught to many of us when we were in kindergarten.

Building a home with a strong foundation is very important so that it won’t be easily destroyed when calamity strikes. Earthquake, fire, flood … these are what we call the acts of gods that we cannot control. It’s best that your home is calamity-proof to protect your family.

It’s difficult to build a new home all over again. We make sure that all materials used are of good quality. We should also have the same mindset in building our financial home. We make sure that each requirement of the financial home is fulfilled to make sure that it will stand firm against any unforeseen events.

These situations can be called SAD events: sickness, accident, and death. Not to be morbid, but death is guaranteed to happen to us. We just don’t know when. It’s best to be ready for it so that your dreams and goals for your family will be fulfilled.

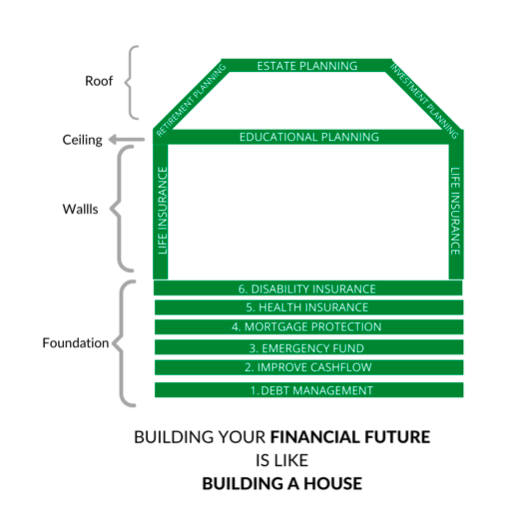

I have here a photo of a strong financial home.

Photo courtesy of legacyoflove.info

First thing to do is to build a strong foundation. The strength of the home starts from the ground up.

In the photo, there are 6 levels at the bottom — the same with an actual home, the deeper the foundation, the stronger it will be.

Foundations of a financial home

Here are the 6 foundations for a strong financial home:

1. Debt Management – For more details, check out my previous article on how to get out debt quickly.

2. Budget Management – You need to list all your expenses every month. Decide on a budget and commit to it.

3. Emergency Funds – For more information, read on here on what you need to know about emergency funds.

4. Mortgage Redemption – If you have a loan, make sure that you get an equivalent life insurance coverage at least based on your outstanding balance. This way, if ever something happens to you, the debt against your home will automatically be fully paid. Your family will not be burdened to pay off the outstanding balance.

5. Health & Disability Insurance – Be sure to check out this article on the secret to getting a private hospital room amid the pandemic.

Other necessary structures of a financial home

Next, we start putting up its walls. Walls represent income continuation. Without it, the residents of said home won’t survive. We need to insure the breadwinner for 10 times of his annual income. Why 10 times? It’s 10 years worth of the breadwinner’s possible annual income so that the people left behind will be able to maintain their current lifestyle.

Then, we take care of the ceiling. The ceiling represents education planning for families with children. Tuition fees increase significantly over time. Therefore, parents must start planning for it to ensure their children’s education.

Lastly comes the roof. The roof represents retirement planning and investment planning, and the highest level of the roof is estate planning.

Retirement planning is accumulating wealth to a certain point that passive earnings can be used for your monthly needs, becoming financially independent for life.

Investment planning is about accumulating wealth dedicated to purchase a large asset in the future.

Lastly, estate planning is about leaving a legacy to our children and grandchildren. We, Chinoys, would like to be an angkong or ama someday who gives ang pao to their grandchildren, right? Preparing for estate planning is not only giving ang pao but also ensuring a bright future for our children and grandchildren.

Preparing your financial blueprint needs proper planning and it takes time.

If it feels like a lot of information, don’t worry. Watch out for my future articles as I will dissect each topic one by one.

About the author

Sheila Ong is a legacy architect. She helps Chinoy families plan and design their financial homes by not only creating a strong financial foundation but also peace of mind, allowing families to do what matters most, which is to have more time to spend with each other. It’s her passion to empower each Chinoy family to create a legacy of love from one generation to the next through proper wealth management. As a naturally shy person, she evolved into becoming a public speaker driven by her advocacy. She has transformed many lives, including the lives of her team of financial advisors and the lives of about 400 families who are now financially secure. Sheila also values family time as she is a full-time mom to her son.

Sheila Ong is a legacy architect. She helps Chinoy families plan and design their financial homes by not only creating a strong financial foundation but also peace of mind, allowing families to do what matters most, which is to have more time to spend with each other. It’s her passion to empower each Chinoy family to create a legacy of love from one generation to the next through proper wealth management. As a naturally shy person, she evolved into becoming a public speaker driven by her advocacy. She has transformed many lives, including the lives of her team of financial advisors and the lives of about 400 families who are now financially secure. Sheila also values family time as she is a full-time mom to her son.

If you want to know more, you may send her an email at sheila@legacyoflove.info. For more information, you may also check out her website, https://legacyoflove.info/ and Facebook page, https://www.facebook.com/legacyoflovewithsheila/, and subscribe to her newsletter here.